Lattice Semiconductor Reports Second Quarter 2015 Results

NEWS RELEASE

For more information contact:

Joe Bedewi

Chief Financial Officer

Lattice Semiconductor Corporation

503-268-8000

David Pasquale

Global IR Partners

914-337-8801

lscc@globalirpartners.com

LATTICE SEMICONDUCTOR REPORTS SECOND QUARTER 2015 RESULTS

Second Quarter 2015 Financial Highlights*:

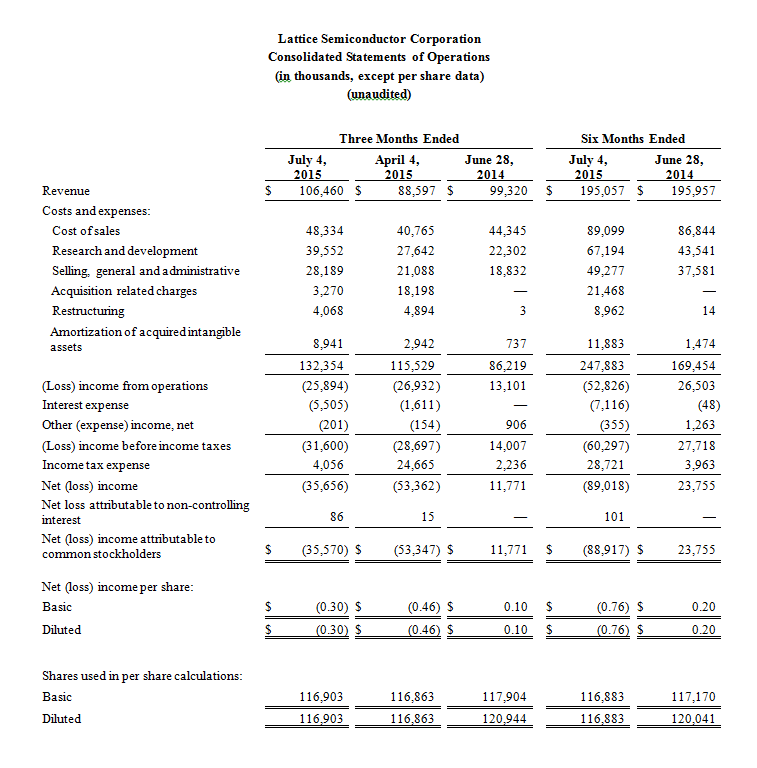

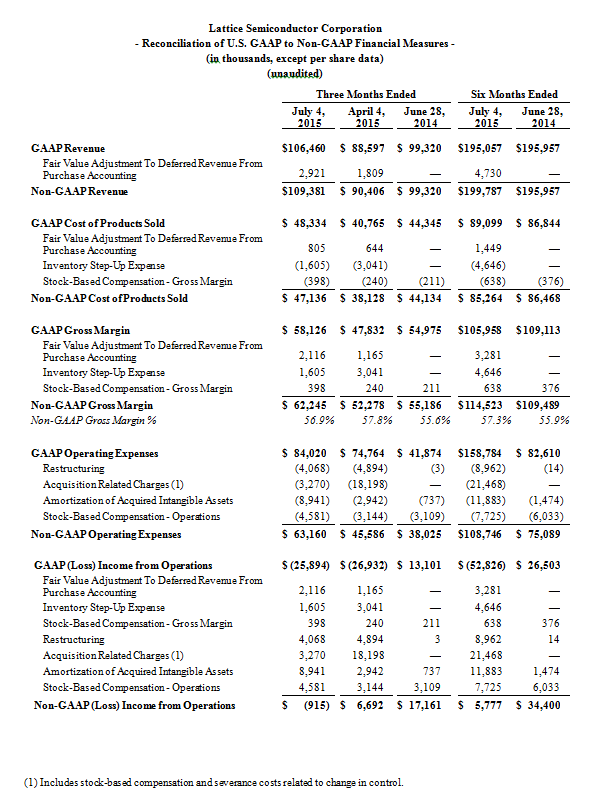

- Revenue of $106.5 million on a GAAP basis and $109.4 million on a non-GAAP basis.

- Net loss of $35.6 million or $0.30 per basic and diluted share on a GAAP basis, compared to net loss of $8.6 million or $0.07 per basic and diluted share on a non-GAAP basis. GAAP results reflect $4.1 million in restructuring costs, $3.3 million in acquisition related charges, a $4.1 million tax provision, $8.9 million in amortization of acquired intangible assets and $5.0 million in stock based compensation expense.

- Gross margin of 54.6% on a GAAP basis and 56.9% on a non-GAAP basis.

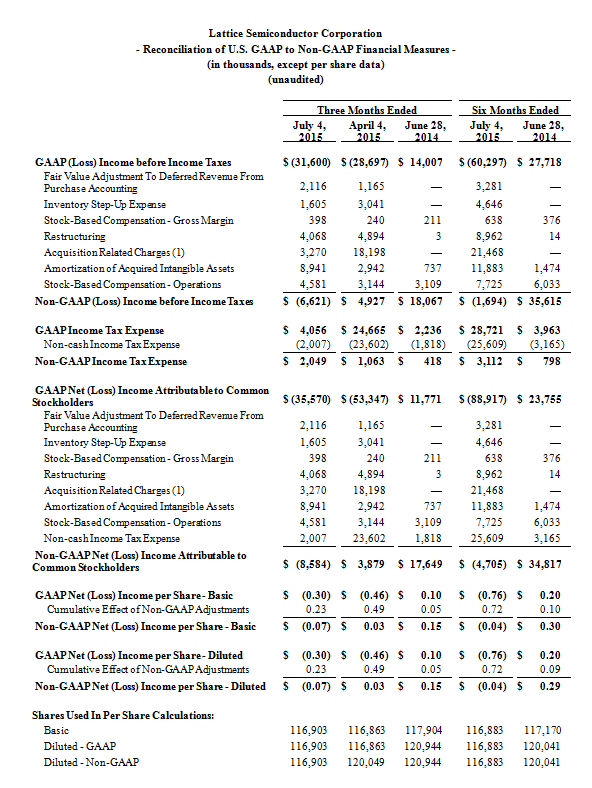

* For a reconciliation of GAAP to non-GAAP results, see accompanying tables "Reconciliation of U.S. GAAP to Non-GAAP Financial Measures."

PORTLAND, OR - July 30, 2015 - Lattice Semiconductor Corporation (NASDAQ: LSCC), the global leader in smart connectivity solutions, announced financial results today for the fiscal second quarter ended July 4, 2015.

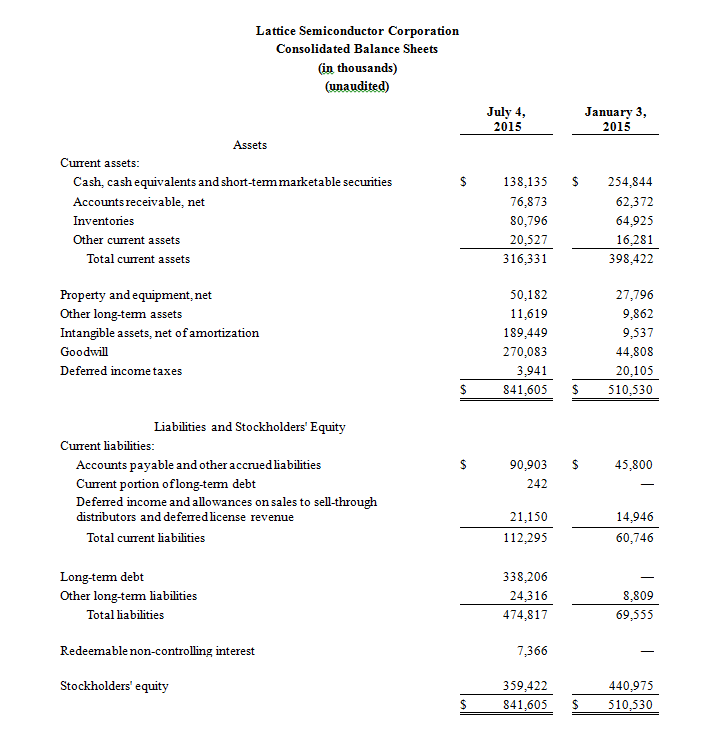

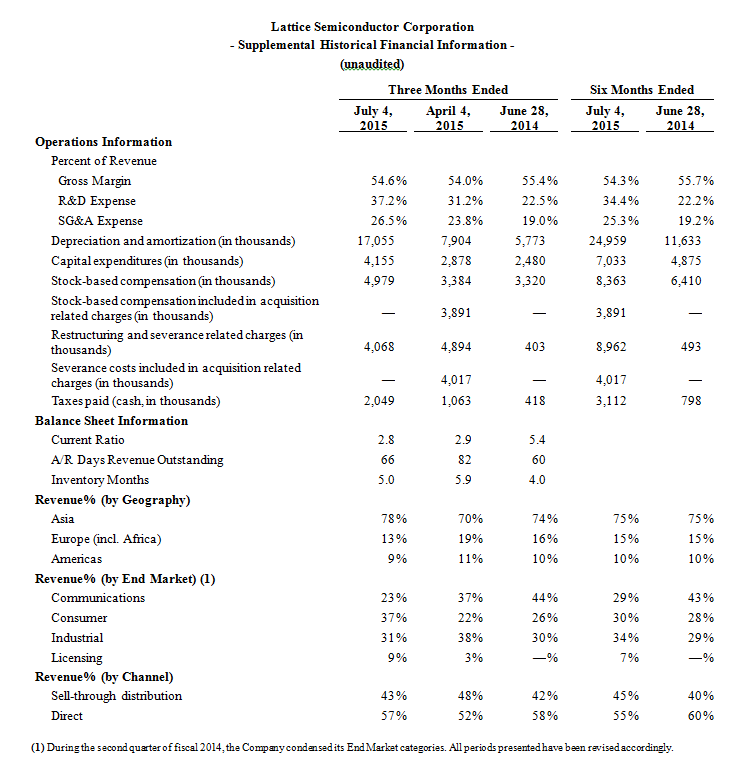

The Company reported record quarterly revenues on a GAAP basis of $106.5 million, which was up 20% sequentially, as compared to the first quarter 2015 revenue of $88.6 million, and was up 7%, as compared to the second quarter 2014 revenue of $99.3 million. Revenue for the second quarter 2015 was $109.4 million on a non-GAAP basis. Gross margin on a GAAP basis was 54.6% for the second quarter of 2015, as compared to first quarter 2015 gross margin of 54% and 55.4% for the second quarter of 2014. Gross margin for the second quarter 2015 was 56.9% on a non-GAAP basis. Total operating expenses for the second quarter 2015 were $63.2 million on a non-GAAP basis.

Financial results for the prior quarter included the financial results of Silicon Image only for the period subsequent to the closing of the acquisition of Silicon Image by the company on March 10, 2015.

Net loss for the second quarter on a GAAP basis was $35.6 million ($0.30 per basic and diluted share), with second quarter net loss on a non-GAAP basis of $8.6 million ($0.07 per basic and diluted share). GAAP results for the second quarter of 2015 reflect $4.1 million in restructuring costs, $3.3 million in acquisition related charges, a $4.1 million tax provision, $8.9 million in amortization of acquired intangible assets and $5.0 million in stock-based compensation expense. This compares to a net loss on a GAAP basis in the prior quarter of $53.3 million ($0.46 per basic and diluted share), and net income of $3.9 million ($0.03 per basic and diluted share) on a non-GAAP basis; and compares to net income on a GAAP basis in the year ago period of $11.8 million ($0.10 per basic and diluted share), or $17.6 million ($0.15 per basic and diluted share) on a non-GAAP basis. GAAP results for the first quarter of 2015 reflect $4.9 million in restructuring costs, $18.2 million in acquisition related charges, a $24.7 million tax provision, $2.9 million in amortization of acquired intangible assets and $3.4 million in stock-based compensation expense.

Darin G. Billerbeck, President and Chief Executive Officer, said, "Revenue in the second quarter 2015 was the highest for the Company in almost 15 years. While this was below our expectations for the quarter, we remain on track to achieve double-digit revenue growth for the full year 2015, consistent with the double digit growth rate we have delivered since diversifying into the consumer market a few years ago. Q2 was an anomaly as we were hit with a series of macro-related customer issues, which are not a reflection of our ongoing business or the many high potential growth opportunities we already have in place. While we expect headwinds in Q3 from lingering macro weakness worldwide, we are executing against a robust sales pipeline and remain focused on winning increased share in each of our end markets. Importantly, we continue to control the many variables under our power as we leverage our scale to drive non-GAAP operating income to our 20% target."

Joe Bedewi, Corporate Vice President and Chief Financial Officer, added, "We achieved our gross margin target as efficiencies in our cost structure more than offset pressure on our revenue. Total operating expenses were $63.2 million on a non-GAAP basis for the second quarter, which compares to our guidance of approximately $65.2 million plus or minus 2% on a non-GAAP basis. The sequential increase compared to Q1 was primarily due to the full quarter inclusion of our acquisition of Silicon Image. Restructuring and acquisition related charges, including amortization of acquired intangible assets, were $4.1 million and $12.2 million, respectively, for the second quarter. We have already achieved $33 million in synergies and are on track to meet our current synergies goal of $42 million. We are also adjusting our current and 2016 operating expense model to reflect the expected lower near-term revenue. These actions are consistent with our focus on driving free cash flow and actively reducing debt."

Recent Business Highlights

- Expands Relationship with Huawei: Lattice's iCE40 LM FPGA was integrated into the new Huawei P8 flagship smartphone to enable optimal 4G reception. Huawei will continue to use Lattice’s low latency, tunable antenna controller in other devices incorporating its Kirin 930 chipset.

- ZTE Chooses Lattice: Lattice's iCE40 LM FPGA was integrated into the recently released ZTE Star 2 flagship smartphone to perform IR remote control, and sensor hub functions. ZTE was able to individually decide which functions to incorporate, targeting the features of each model, while simultaneously saving board space, cost and power, and improving reliability and performance.

- Partners with Google: Google ATAP selected Lattice's SiBEAM® as one of the partners to bring touchless gesture sensing to the next generation of smart devices. Based on SiBEAM’s millimeter-wave (mmWave) innovations, this technology enables rich hand gesture interactions with smart devices and small wearables, without the limitations of ever-shrinking screen sizes.

- Launches MachXO3LF™: Lattice launched the MachXO3LF™ device, the newest member of its MachXO3™ FPGA family, which provides essential bridging and I/O expansion functions to meet the increasing connectivity requirements of communications, computing, consumer and industrial markets. Customers now have multiple footprint compatible options: the MachXO3L device, which offers low-cost reprogrammable non-volatile configuration memory, and now the MachXO3LF device with on-chip Flash memory.

- Letv's Le Max Smartphone Win: Lattice's SiBEAM announced a key UltraGig™ design win with Letv’s Le Max smartphone. Featuring SiBEAM’s UltraGig SiI6400 transmitter, Le Max is the world’s first smartphone offering 60GHz millimeter-wave wireless video technology in volume production. The UltraGig SiI6400 transmitter is a single-chip solution that integrates network processor, RF transceiver, and in-package antennas, offering Full HD quality with near-zero latency for immersive entertainment and gaming.

Business Outlook - Third Quarter and Full Year 2015:

- Revenue for the third quarter of 2015 is expected to be approximately flat to up 6% on a non-GAAP basis, as compared to the second quarter of 2015, with revenue on a non-GAAP basis for the full year 2015 now expected to be approximately 10% below $485 million, which was the midpoint of prior guidance.

- Gross margin percentage for both the third quarter and full year 2015 is expected to be approximately 56.5% plus or minus 2% on a non-GAAP basis.

- Total operating expenses, excluding acquisition or restructuring related charges, are expected to be approximately $60 million plus or minus 2% on a non-GAAP basis for the third quarter of 2015, and approximately $215 million plus or minus 2% on a non-GAAP basis for the full year 2015, which includes the benefit of synergy savings.

- Restructuring charges are expected to be approximately $7.0 million for the third quarter of 2015 and approximately $25 million for the full year 2015.

- Acquisition related charges, including amortization of acquired intangible assets are expected to be approximately $9.5 million in the third quarter of 2015, and approximately $52.2 million for the full year 2015.

- The Company reaffirms that it expects operating synergies to be approximately $42 million on an annualized basis as it exits 2015.

Investor Conference Call / Webcast Details:

Lattice Semiconductor will review the Company's financial results for the second quarter of 2015 and business outlook for the third quarter and full year 2015 on Thursday, July 30, 2015 at 5:00 p.m. Eastern Time. The conference call-in number is 1-888-286-6281 or 1-706-643-3761 with conference identification number 86389650. A live webcast of the conference call will also be available on Lattice's website at www.latticesemi.com. The Company's financial guidance will be limited to the comments on its public quarterly earnings call and the public business outlook statements contained in this press release.

A replay of the call will be available approximately 2 hours after the conclusion of the live call through 11:59 p.m. Eastern Time on August 13, 2015, by telephone at 1-404-537-3406. To access the replay, use conference identification number 86389650. A webcast replay will also be available on the investor relations section of www.latticesemi.com.

Forward-Looking Statements Notice:

The foregoing paragraphs contain forward-looking statements that involve estimates, assumptions, risks and uncertainties. Such forward-looking statements include statements relating to: our expectation that we remain on track to achieve double-digit revenue growth for the full year 2015; that we will be able to leverage our scale to drive non-GAAP operating income to our 20% target; and those statements under the heading “Business Outlook - Third Quarter and Full Year 2015” relating to expected revenue, gross margin, total operating expenses, synergies and acquisition charges, including amortization of acquired intangible assets. Other forward-looking statements may be indicated by words such as “will,” “could,” “should,” “would,” “expect,” “plan,” “anticipate,” “intend,” “forecast,” “believe,” “estimate,” “predict,” “propose,” “potential,” “continue” or the negative of these terms or other comparable terminology. Lattice believes the factors identified below could cause actual results to differ materially from the forward-looking statements.

Estimates of future revenue are inherently uncertain due to, among other things, the high percentage of quarterly “turns” business. In addition, revenue is affected by such factors as global economic conditions, which may affect customer demand, pricing pressures, competitive actions, the demand for our products, and in particular our iCE40™ and MachXO3L™ devices, the ability to supply products to customers in a timely manner, changes in our distribution relationships, or the volatility of our consumer business. Actual gross margin percentage and operating expenses could vary from the estimates on the basis of, among other things, changes in revenue levels, changes in product pricing and mix, changes in wafer, assembly, test and other costs, including commodity costs, variations in manufacturing yields, the failure to sustain operational improvements, the actual amount of compensation charges due to stock price changes. Any unanticipated declines in revenue or gross margin, any unanticipated increases in our operating expenses or unanticipated charges could adversely affect our profitability. In addition, our results could vary due to our acquisition of Silicon Image. We have not had experience operating Silicon Image or projecting its operating results. The acquisition of another company carries inherent risks, including our discovering unknown liabilities or encountering unanticipated issues relating to integrating the business with ours. Any unanticipated declines in revenue or gross margin, any unanticipated increases in our operating expenses or unanticipated charges, including without limitation, restructuring charges, or issues with integrating Silicon Image, could adversely affect our profitability.

In addition to the foregoing, other factors that may cause actual results to differ materially from the forward-looking statements in this press release include global economic uncertainty, overall semiconductor market conditions, market acceptance and demand for our new products, the Company's dependencies on its silicon wafer suppliers, the impact of competitive products and pricing, technological and product development risks, and the other risks that are described in this press release and that are otherwise described from time to time in our filings with the Securities and Exchange Commission. The Company does not intend to update or revise any forward-looking statements, whether as a result of events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Non-GAAP Financial Measures:

Included within this press release and the accompanying tables and notes are non-GAAP financial measures that supplement the Company's consolidated financial information prepared under GAAP. The Company describes these non-GAAP financial measures and reconciles them to the most directly comparable GAAP measures in the tables and notes attached to this press release. The Company's management believes that these non-GAAP measures provide a more meaningful representation of the Company’s ongoing financial performance than GAAP measures alone. In addition, the Company uses Adjusted EBITDA to measure compliance with certain of its debt covenants. These non-GAAP measures are included solely for informational and comparative purposes and are not meant as a substitute for GAAP and should be considered together with the consolidated financial information located in the tables attached to this press release.

About Lattice Semiconductor:

Lattice Semiconductor (NASDAQ: LSCC) is the global leader in smart connectivity solutions, providing market leading intellectual property and low-power, small form-factor devices that enable more than 8,000 global customers to quickly deliver innovative and differentiated cost and power efficient products. The Company’s broad end-market exposure extends from consumer electronics to industrial equipment, communications infrastructure and licensing.

Lattice was founded in 1983 and is headquartered in Portland, Oregon. The Company acquired Silicon Image in March 2015, which is a leader in setting industry standards including the highly successful HDMI®, DVI™, MHL® and WirelessHD® standards.

For more information, visit www.latticesemi.com. You can also follow us via LinkedIn, Twitter, Facebook, or RSS.

# # #

Lattice Semiconductor Corporation, Lattice (& design), L (& design), iCE40 and MachXO3L and specific product designations are either registered trademarks or trademarks of Lattice Semiconductor Corporation or its subsidiaries in the United States and/or other countries.

GENERAL NOTICE: Other product names used in this publication are for identification purposes only and may be trademarks of their respective holders.

(1) Includes stock-based compensation and severance costs related to change in control.